Volatility and Time Reversal Asymmetry

(Published by JP Bouchaud | July 2022)

Among the most fascinating “stylized facts” of financial price series lies their lack of symmetry under time reversal. Although it may seem obvious that past and future should play a different role in financial markets, most stochastic volatility (SV) models actually fail to capture this property! For example, the original version of the multifractal random walk model, together with its “rough volatility” generalizations, are time reversal symmetric.

The simplest time reversal asymmetry is the so-called "leverage effect", i.e. the fact that past price drops lead to an increase in future volatility, but not vice-versa. This is fairly easy to account for in SV models. But note that this effect simultaneously violates time reversal and return reversal symmetry.

More subtle are effects that are time reversal asymmetric but unaffected by the sign of returns. One is the volatility profile around unanticipated news: volatility is flat before the news, then jumps and slowly decays after the news. Another is even more subtle: past price trends, both up or down, induce more future volatility – but not the other way around. This is the Zumbach effect.

The intuition is that unexplained local trends make liquidity providers wary that something they don’t know is going on. They take shelter, leading to increased spreads and increased volatility (this process can go haywire and generate purely endogenous price jumps -- this was the story of another post).

Hawkes processes provide a natural framework to capture these feedback effects. But when calibrated to real data, all time asymmetry somehow disappear. A way out, which explicitly factors in the Zumbach effect, was proposed a few years back by Blanc, Donier, and myself in this paper.

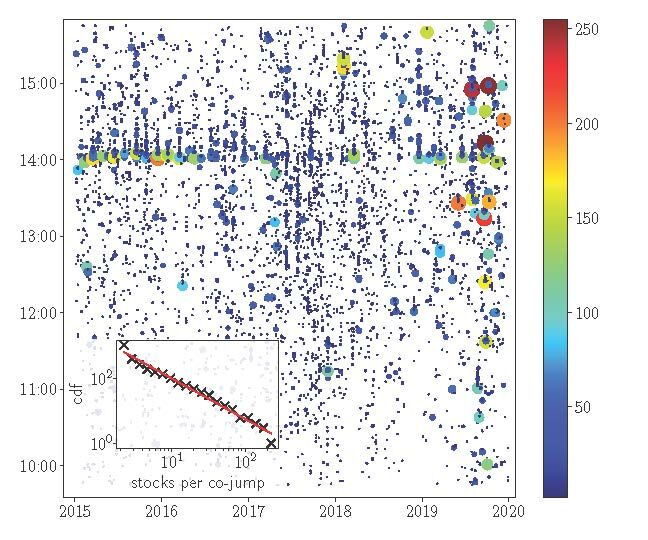

Such a model in fact naturally generates power-law tails, absent in standard Hawkes processes. Cecilia Aubrun (the first recipient of the CFM WIQF PhD grant) very recently generalized the model to a multivariate setting in this paper, in order to account for the cross effect of trends that can generate “co-jumps” and many other interesting effects.