The Self-Organized Criticality Paradigm in Economics & Finance

(Published by JP Bouchaud | July 2024)

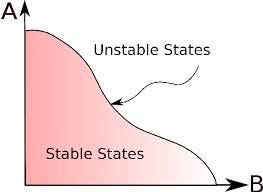

Many systems made up of a large number of interacting items appear to be “marginally stable” i.e. close to an incipient instability, or tipping point. The scenario according to which these systems are spontaneously driven towards such a fragile state is called “self-organised criticality” (SOC), and was proposed by Per Bak as a generic mechanism that allows one to explain large endogenous fluctuations in complex systems, ranging from natural systems (avalanches, earthquakes, floods, solar flares, turbulence...), ecological systems (mass extinctions), biological neural networks (epilepsy), bird flocks and fish schools (collective motion), socio-technical systems (black-outs, traffic jams, failure cascades,...)

Financial markets and global economies are equally prone to such wild fluctuations. History is strewn with bubbles and crashes, booms and busts, crises and upheavals of all sorts. Understanding the origin of these dramatic events (and the remote possibility of curbing them) is arguably one of the most important problems in economic theory.

Are these events exogenous (due to a shock from outside the system) or endogenous (generated by internal feedback loops)?

This did not escape Per Bak's sagacity. He was quick to transpose ideas born in the context of statistical physics to economic situations, with the suggestion that the substantial, unexplained year on year GDP fluctuations of large developed economies -- the so-called “small shocks, large business cycle puzzle” -- could in fact result from the inherent fragility of economic systems that prevents fluctuations to vanish, even for large system sizes.

The financial markets analogue of excess GDP fluctuations is the equally well-known “excess volatility puzzle” elicited by R. Shiller and by LeRoy-Porter.

Asset prices frequently undergo large jumps for no particular reason, when financial economics asserts that only unexpected news can move prices. Volatility is an intermittent, scale invariant process that resembles the velocity field in turbulent flows. Small, seemingly innocuous perturbations can end up sending the market in shambles -- like “Black Monday” in October 1987 or the infamous “Flash Crash” of May 6th, 2010.

But such extreme events are not isolated outliers. Just as earthquake severity can span orders of magnitude, from hardly detectable tremors to devastating calamities, the probability distribution of price returns exhibit a power-law tail typical of complex systems sitting in the vicinity of a critical point. Again, temptation is high to invoke a kind of spontaneous coordination of competing market participants right at the border of chaos.

The aim of my recent review (prompted by Doyne Farmer) is to discuss whether such a paradigm makes sense in the context of economic systems and financial markets (see this paper).